The easiest and fastest way to prepare customs declarations

All designed to help you prepare customs declarations quickly.

Features the integrated EU trade tariff alongside the national trade tariffs of Italy, Germany, Belgium, the Netherlands, Sweden, Switzerland, the UK, and the US.

Available in all 22 European languages

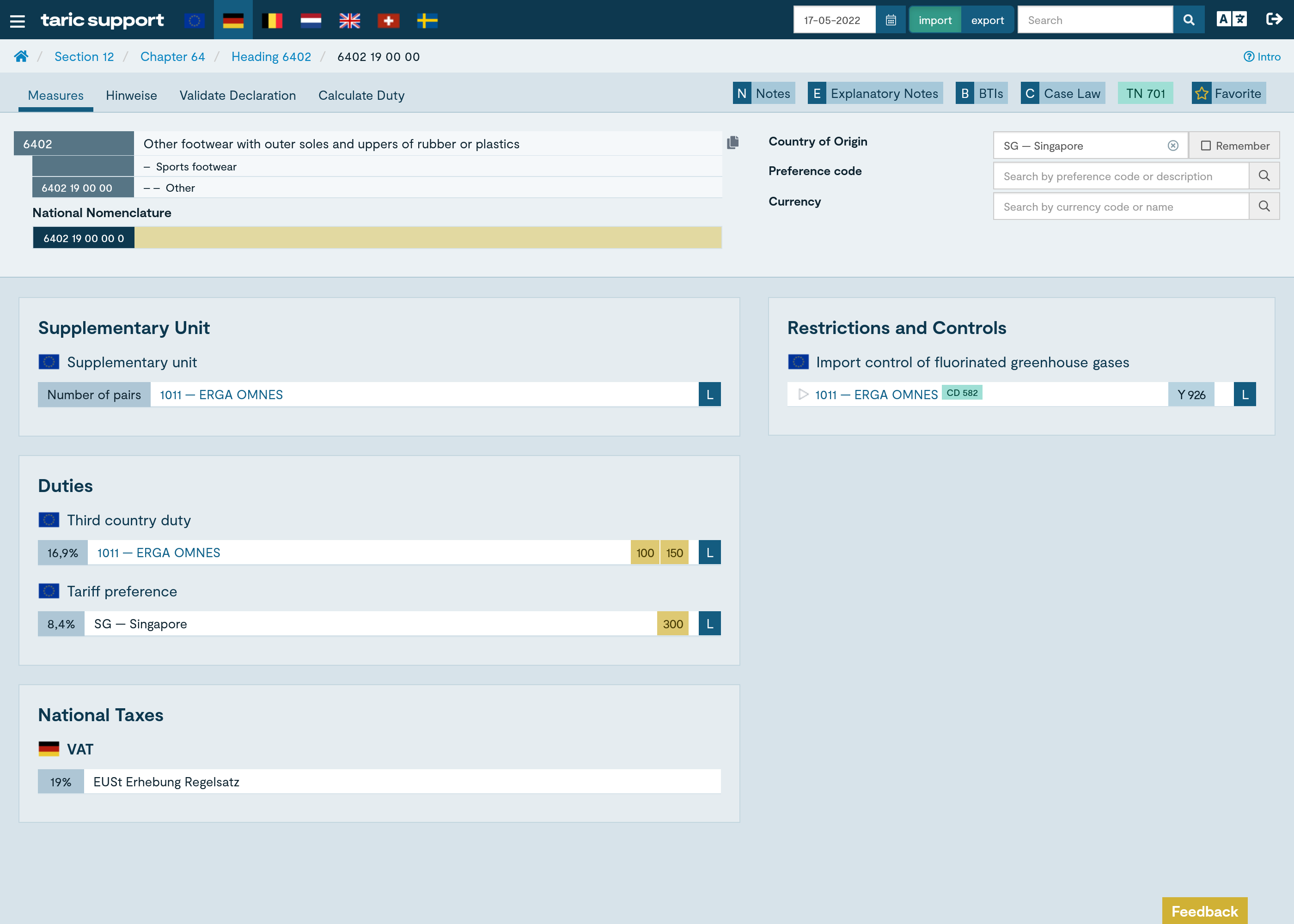

- Duties and taxes

- Prohibitions, Restrictions and Controls

- Antidumping Measures

- Meursing calculator and reference prices for agricultural products

- Additional codes filters

- Rules and regulations

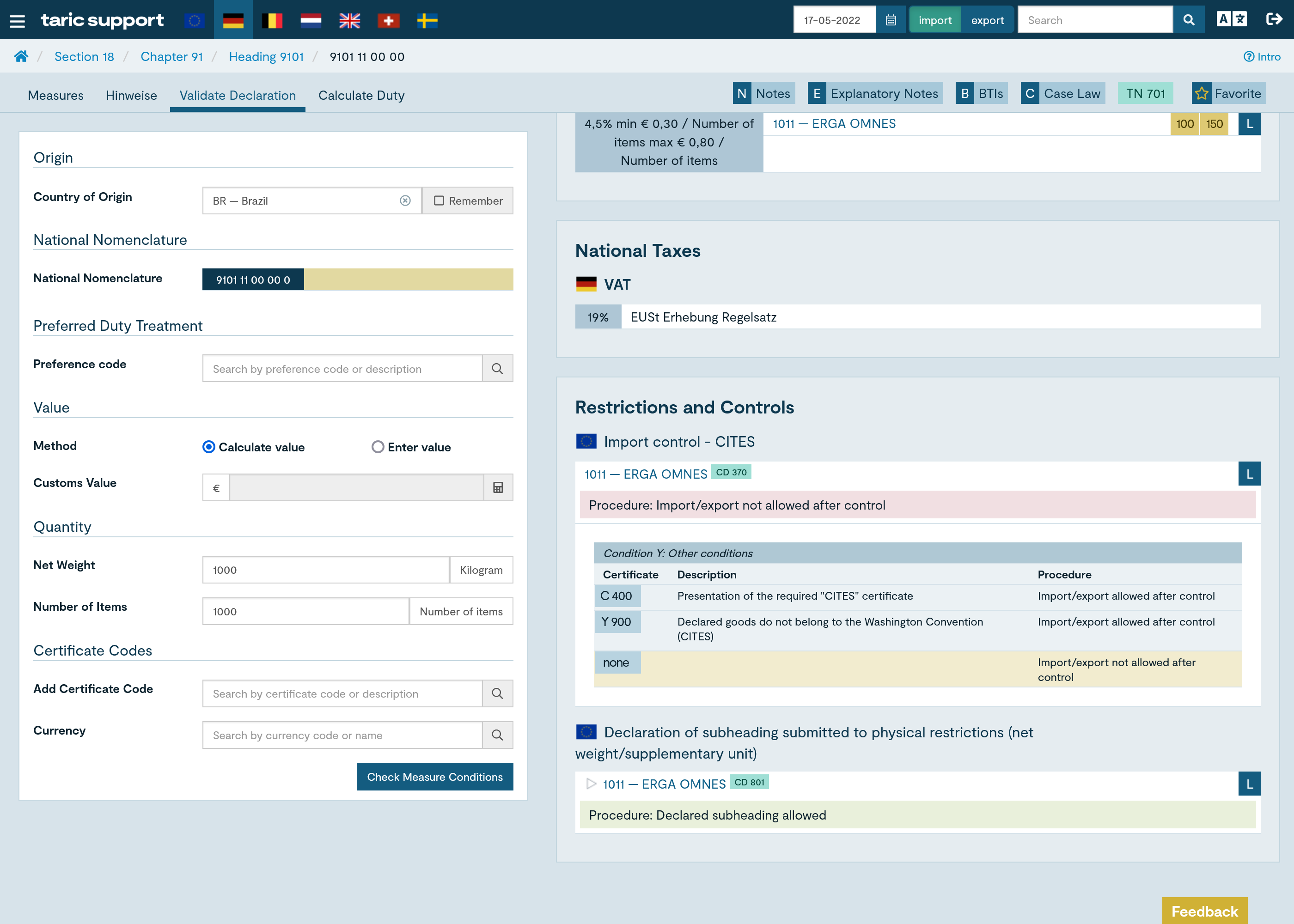

Validate declaration lines before submission to customs

Our declaration validator is the quickest and simplest way to check your customs declarations before submission, allowing you to:

- Validate commodity codes

- Validate additional codes

- Validate certificate codes and Y codes

- Check prohibitions and restrictions related to customs value, net weight, and/or supplementary values

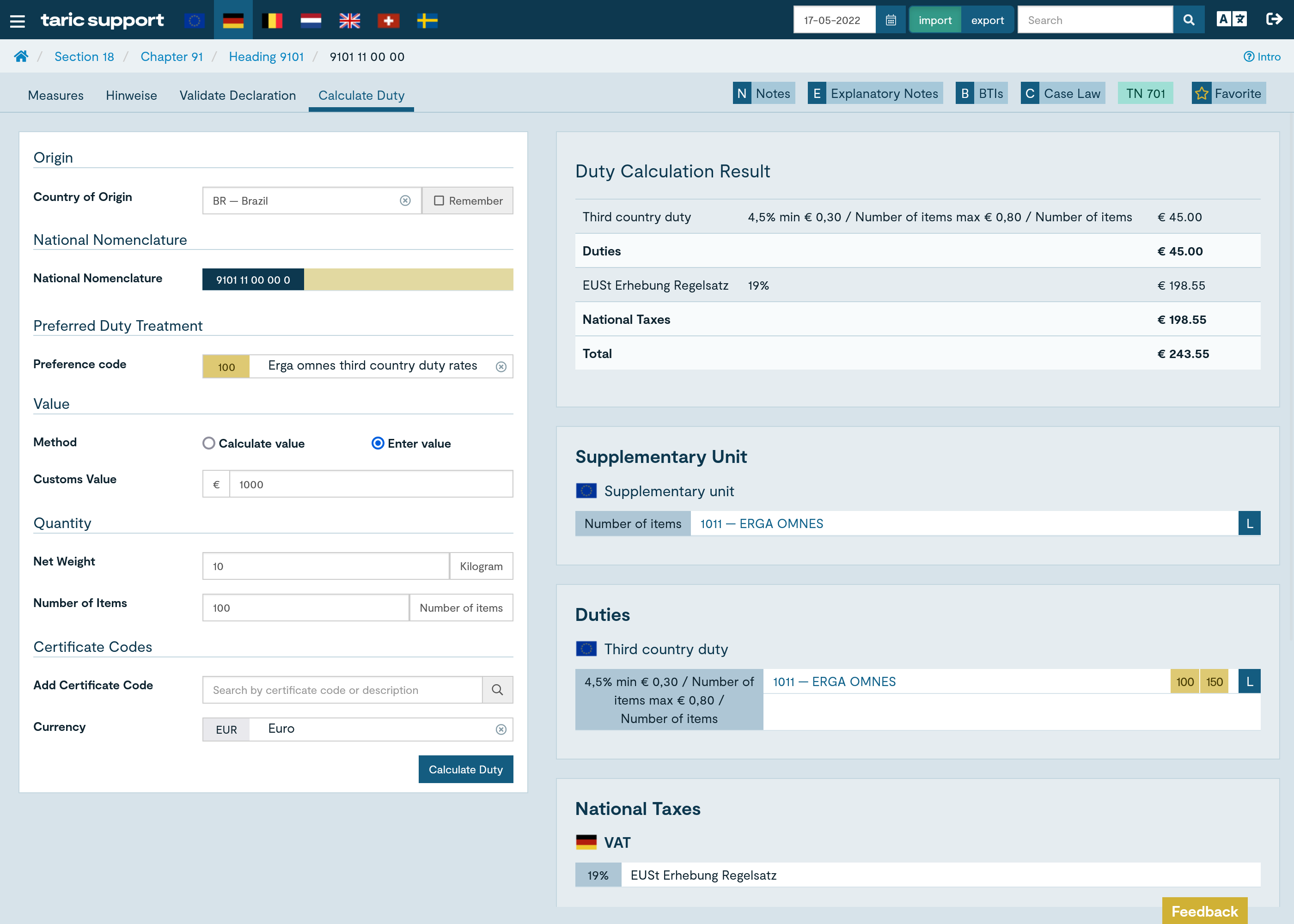

Calculate import duties for the EU and GB

Supports all types of duties in the European customs tariff (TARIC) and the UK Global Tariff (UKGT), including:

- Ad valorem duties and duties based on various quantities, such as weight, volume, or number of items

- Import duties for agricultural products requiring a Meursing additional code

- Duty rates linked to the entry price system

- Anti-dumping and countervailing duties

All trade tariff data powering the duty calculator is updated daily for maximum accuracy.

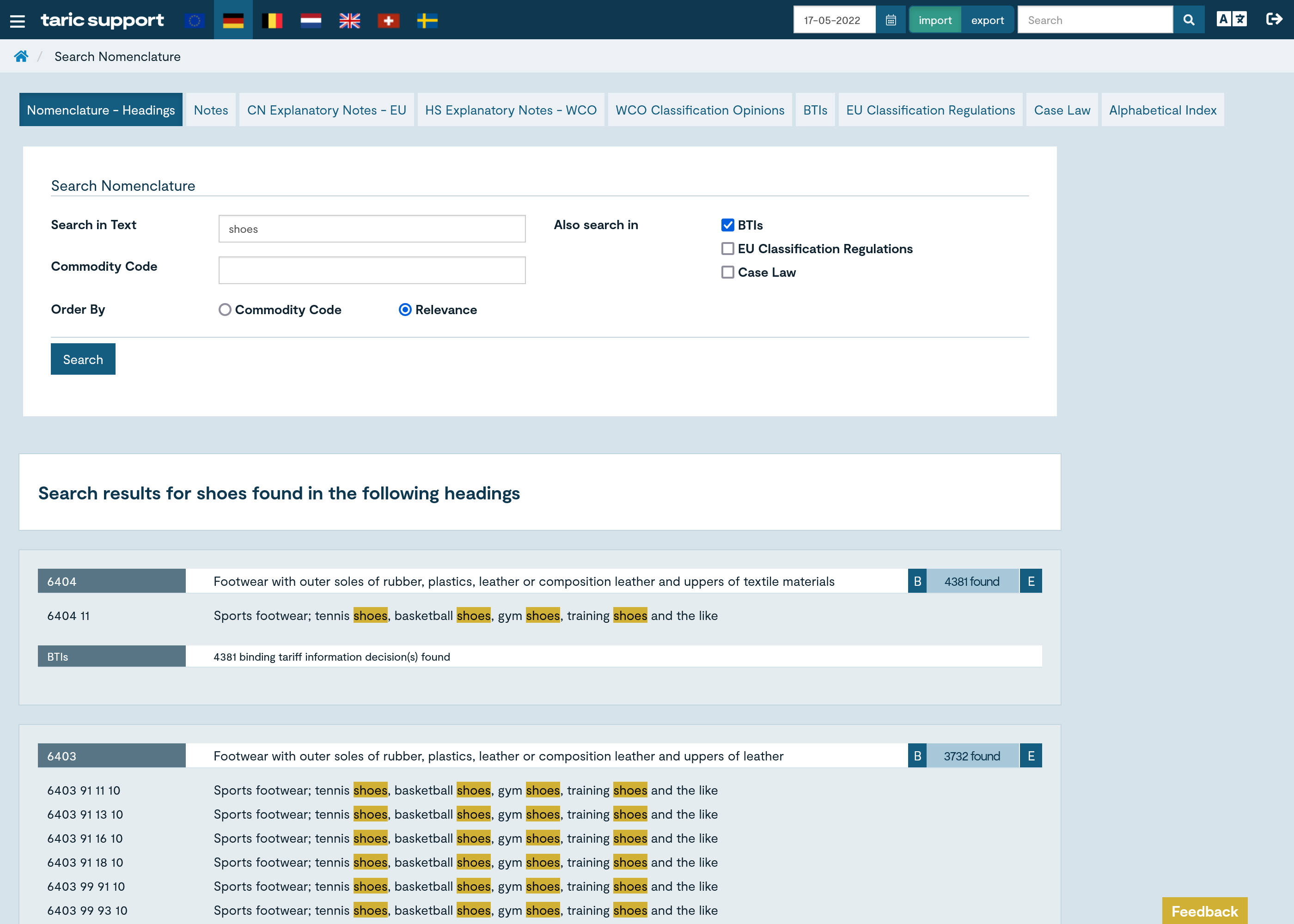

Everything you need to classify with confidence

We keep everything up to date. If an explanatory note changes, for example, we update it promptly so you’re always working with the latest information.

- Nomenclature with descriptions in all EU languages

- Section and chapter notes

- WCO explanatory notes and classification opinions

- EU classification regulations

- Relevant case law on product classification

- An alphabetical index of classified products

- The complete EBTI database: hundreds of thousands of customs-classified product examples, including a history of BTIs that are no longer valid but still highly useful

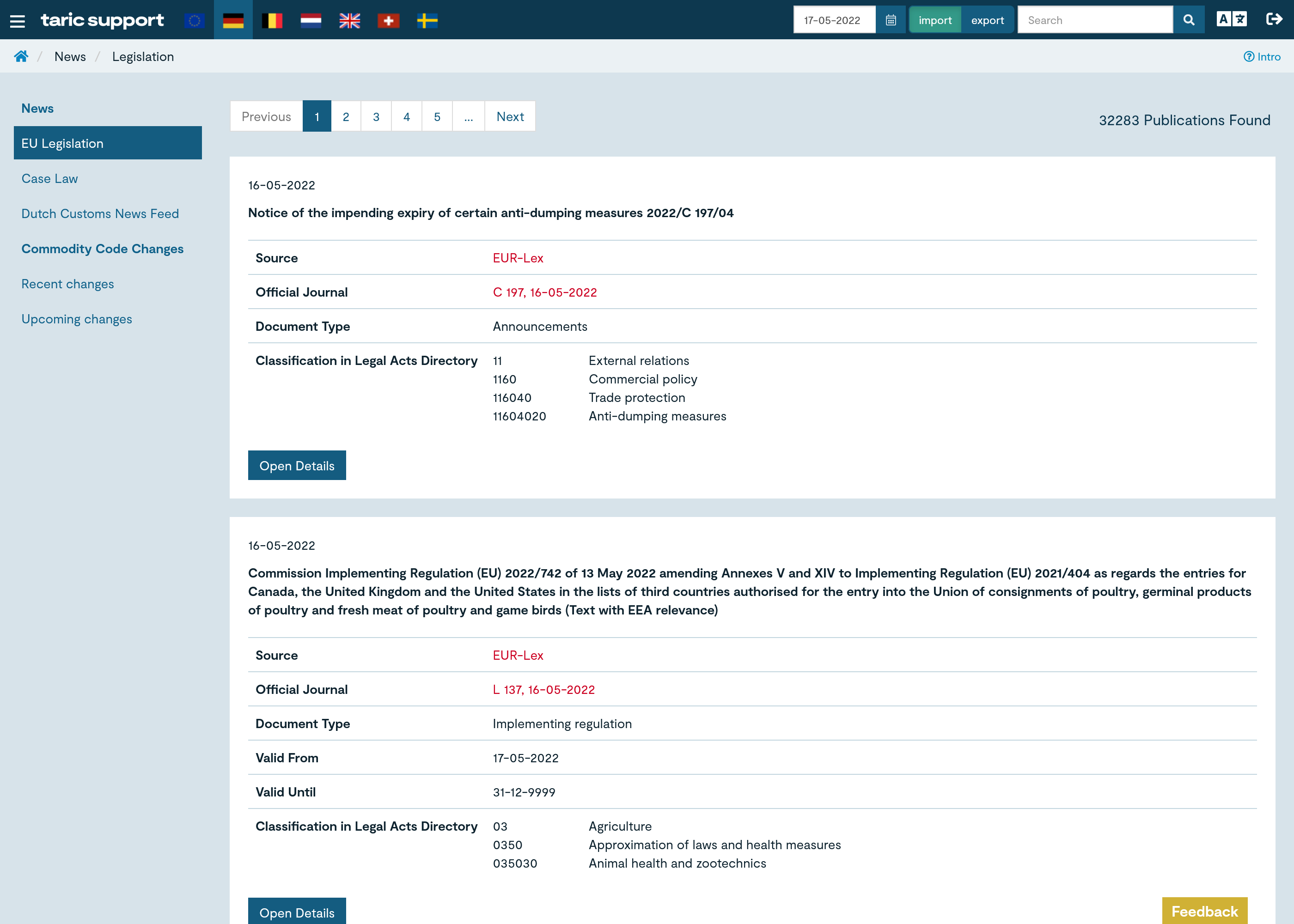

The latest news on legislation and case law

Manually scanning sources like EUR-Lex and CURIA every day can be a huge time drain; they try to serve everyone, often overwhelming you with irrelevant information. That’s why we focus solely on delivering the news you actually need.

- A news feed with the latest rules and regulations from EUR-Lex

- The newest notices to importers and exporters (e.g., updates on anti-dumping measures)

- An overview of recent customs-related case law

- A correlation table showing which HS codes have changed and how

- The latest binding tariff information from EBTI

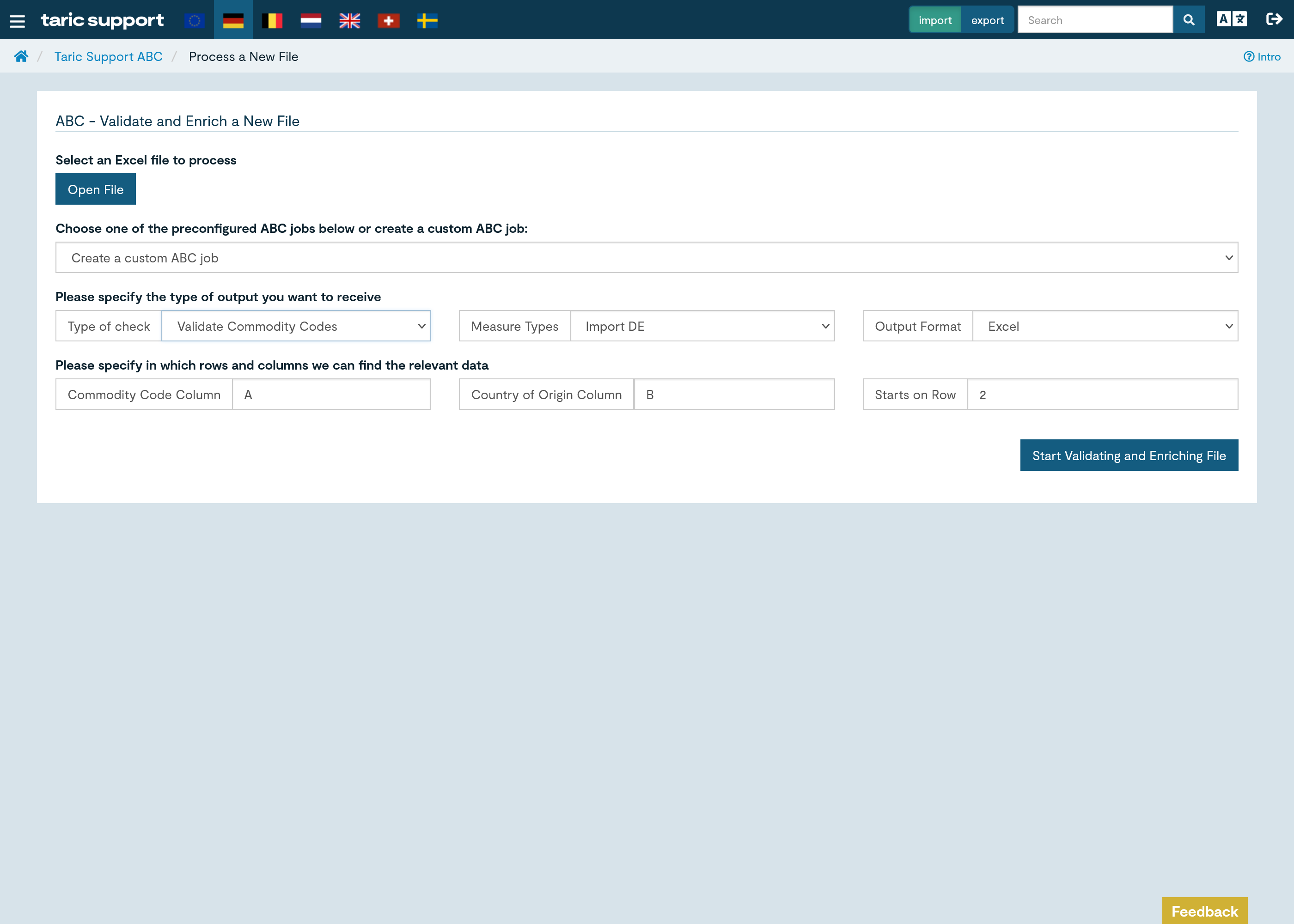

Validate and enrich hundreds of codes per minute

How does it work? Simply upload a file — whether it’s a master data file, order manifest, or customs declaration. Choose the type of validation and press start. Within seconds, you can download an Excel file packed with valuable information.

First, the results of the commodity code validation:

- Commodity codes are flagged as valid or invalid

- Possible completions are suggested for incomplete codes

This lets you quickly identify errors and begin fixing the data. But that’s not all — ABC adds a range of trade tariff data to the output file, such as:

- Commodity code descriptions

- Additional codes

- Particular provision codes (Y‑codes)

- Certificate codes

- Duty and tax rates

Taric Support ABC combines the power of our API with the convenience of uploading and downloading Excel files, making your workflow seamless and efficient.

2025 Pricing

Application subscription

WCO Explanatory Notes module

German trade tariff

Case Law module

Taric Support ABC

At Taric Support, we’re driven by customs data.

We’re customs information experts who thrive on complexity. Digging into legislation and data is what we do best. We carefully analyse every possible source to provide you with a wide range of relevant and up to date customs information. With this meticulous approach, we help you avoid costly mistakes and delays. Because we’ve been through the process ourselves, we understand exactly what it takes to meet all customs formalities efficiently and confidently.